1. Introduction

2. Data and Methodology

2.1 Data

2.2 Methodology

3. Estimation Results and Discussion

4. Conclusions

1. Introduction

An open economy that heavily relies on international trade is substantially influenced by fluctuations in international prices and exchange rates on its domestic prices. In the industries of paper and paper products, increases in import prices denominated in foreign currencies can drive up domestic prices by increasing demand for locally produced alternatives. Depreciation of the domestic currency can also lead to higher domestic prices for paper and paper products, thus affecting overall domestic inflation. Understanding how exchange rate fluctuations, particularly during currency depreciation and appreciation, impact domestic prices is crucial for the price risk management in the business sector and for the policy makers.

This paper aims to empirically assess how domestic producer prices of paper and paper products in the Republic of Korea are influenced by international prices and exchange rates, distinguishing between short-run and long-run effects, and differentiating between periods of currency depreciation and appreciation. Domestic producer prices are represented by the Producer Price Index (PPI) for paper and paper products, while international prices are measured using the dollar-based foreign price index for these products. When the exchange rate rises–indicating a currency depreciation–the domestic prices of imported paper and paper products increase, leading to a partial pass-through of higher import costs to domestic inflation. Conversely, the impact of a decreasing exchange rate on domestic prices through pass-through effects is less certain. This paper analyzes this issue in detail.

Research on exchange rate pass-through effects has found that countries with higher exchange rate volatility tend to have higher pass-through elasticities, with significant variations in the transmission mechanisms into import prices over time and across product types, while differential impacts on import and export prices highlight substantial cross-country variations in pass-through levels.1,2,3,4,5,6,7,8)Some studies suggest that exchange rate pass-through is typically less than 0.5, indicating that only a partial effect of exchange rate changes is reflected in domestic prices.9,10) Few studies examine the relationship between exchange rate fluctuations and paper industry prices in Korea, with most focusing primarily on pulp.11,12,13) This paper seeks to extend these findings by providing specific estimates of the exchange rate pass-through in the Korean paper industries.

Econometric models commonly used to estimate exchange rate pass-through during currency fluctuations include the Ordinary Least Squares (OLS), the Vector Autoregression (VAR), and the Error Correction Model (ECM). This study employs the ECM along with a cointegration relationship to estimate both short-run and long-run effects of exchange rate changes on domestic prices. These models offer quantitative insights into how exchange rate fluctuations affect industry-specific prices.

There is a notable gap in research concerning exchange rate pass-through in the industries of paper and paper products, particularly during periods of currency depreciation and appreciation. This study aims to address this gap by quantitatively estimating the effects of exchange rates and foreign prices on domestic producer prices of paper and paper products, thereby enhancing our understanding of price determination mechanisms in Korea.

The structure of this paper is as follows: Section 2 outlines the data and the empirical model used for analyzing producer prices and the exchange rate pass-through. Section 3 discusses the estimation results of the empirical model. Finally, section 4 summarizes the findings and draws conclusions.

2. Data and Methodology

2.1 Data

The data used in this study include PPIs for paper and paper products in Korea, the won/dollar exchange rate, PPIs in the United States, and shipment indices for paper and paper products in Korea. We categorize goods in the paper industry into two groups: paper and paper products. The products in the Korean data are classified according to the Korean Standard Industrial Classification (KSIC), while those in the U.S. data follow the North American Industry Classification System (NAICS). In the Korean PPI system, the subcategory for paper includes printing paper as well as other paper and paperboards. The paper products subcategory encompasses six types of goods: corrugated paper and related products, paper containers, paper stationery and office paper, sanitary paper products, and other paper products.

Table 1.

Matching the categories in producer prices and shipment index

Table 2.

Data description

Since the classification systems used in the Korean PPI, the U.S. PPI, and the Korean shipment index are different, we use the following approach to match the categories of indices for paper and paper products, as shown in Table 1. The indices for paper and paperboard in the U.S. PPI system correspond to paper in the Korean PPI. Therefore, we calculate the average of the U.S. PPIs for paper and paperboard to represent the U.S. PPI for paper. For the shipment index in Korea, the index for paper products is derived by averaging the index of corrugated paper, paper boxes and paper containers, and the index of other paper and paperboard products.

Description of the data is shown in Table 2. The two categories of goods in the analysis are paper and paper products. The data period is from January 1990 to December 2023. We analyze data starting from 1990 because the Korean government introduced greater exchange rate flexibility by adopting the market average exchange rate system in March 1990. In this context, the exchange rate refers to the price of the U.S. dollar in Korean won. The U.S. PPIs are included as proxies for the foreign prices of imported goods in the Korean market. The natural logarithms of the producer prices and the exchange rate are used for the analysis in this paper.

The shipment gap () is defined as the ratio of the deviation from the trend of the shipment index. The shipment index is published in the reports of the Monthly Survey of Mining and Manufacturing by Statistics Korea. It represents the level at which goods produced in factories are transported for sale and is widely used to gauge the short-term economic situation of the entire industry or specific sectors. The trend of the shipment index is derived using the Hodrick-Prescott (HP) filter, which is commonly used to remove cyclical factors from time series economic data. The lambda (λ) parameter for the HP filter is set to 14,400, which is typical for monthly time series data. A positive shipment gap indicates an expansion in market demand, which is typically associated with rising prices of the goods.

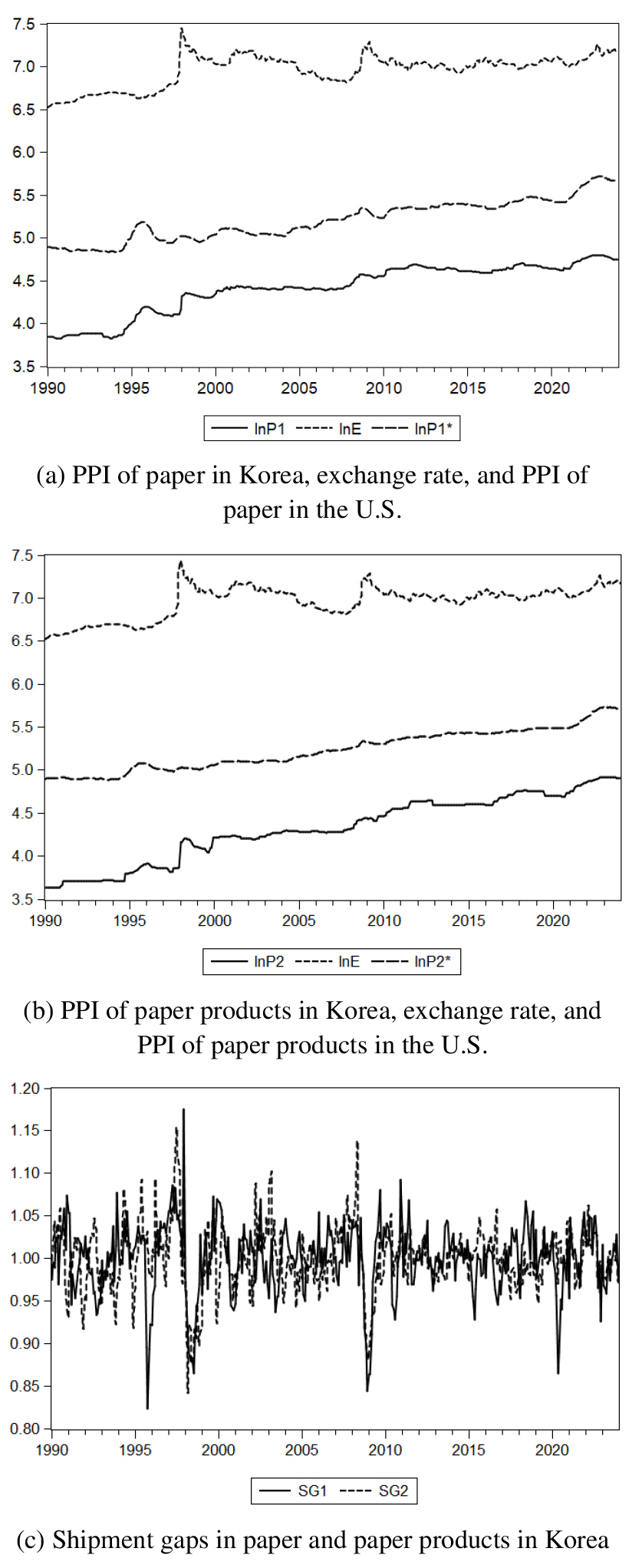

Fig. 1 shows the variables of PPIs for paper and paper products along with related variables such as the exchange rate, U.S. PPIs, and shipment gaps. From (a) and (b), it can be observed that the PPIs for paper and paper products exhibit long-run relationships with the exchange rate and U.S. PPIs. From (c), the shipment gaps for paper and paper products fluctuate around 1.0 and drop sharply during periods of severe economic difficulties in Korea, such as the 1997 currency crisis, the 2008 global financial crisis, and the COVID-19 pandemic in 2020.

2.2 Methodology

The domestic price () for the product is affected by the exchange rate () and the foreign price (). In the context of the industries of paper and paper products, represents the domestic PPIs for either paper or paper products in Korean won, while is the U.S. PPIs for either paper or paper products in U.S. dollars. The U.S. PPIs represent foreign prices of the goods. is the exchange rate in Korean won per U.S. dollar. According to the law of one price, the following equation holds.

Eq. 1 can be modified into a model for estimating the exchange rate pass-through and the effect of foreign prices as in Eq. 2 where indicates one of the two goods (paper and paper products). Here, a time trend, denoted by , is included to account for the effect of continuous changes in other long-run factors.

where =1, 2 (paper for =1 and paper products for =2), for time periods, and 𝜖 is the error term. The coefficient indicates the exchange rate pass-through, which is the percentage change in the domestic producer price in response to a 1 percent change in the exchange rate. The coefficient represents the percentage change in the domestic producer price for a 1 percent change in the foreign price in U.S. dollar, and indicates the time trend effect.

While a long-run relationship can be shown in Eq. 2, a short-run relationship can be represented by an error correction model, as in Eq. 3.

where ∆ denotes the first difference, =1, 2, , and is the error term. Here, the shipment gap () is included to incorporate the market conditions of paper and paper products. The coefficient indicates the exchange rate pass-through in the short-run, the coefficient indicates the effect of foreign prices in the short-run, and is for the effect of shipment gap to the changes in domestic prices. is the error correction term which is the lagged residual from the long-run relationship of Eq. 2. The coefficient of , , shows the speed of mean reversion toward the long-run value of producer prices.

Moreover, the values of exchange rate pass-through could be different between the periods of depreciation and appreciation.6) Thus, we introduce two phases for the effect of changes in the exchange rate as in Eq. 4.

where and are dummy variables indicating exchange rate depreciation (decreasing value of Korean won) and appreciation (increasing value of Korean won), respectively.

3. Estimation Results and Discussion

To estimate Eq. 2, it is necessary to confirm the stationarity of the time series variables. We conducted unit root tests using both the Augmented Dickey-Fuller (ADF) test and the Phillips-Perron (PP) test. Table 3 presents the results of the unit root tests for the time series variables. At the level of the variables, all except the shipment gap were found to have unit roots, indicating non-stationarity. After first differencing, both tests indicated that the variables did not have unit roots. Therefore, it can be said that the first-differenced variables are stationary.

Table 3.

Unit root test result

| Variable | Paper (=1) | Paper products (=2) | |||||||

| ADF | PP | ADF | PP | ||||||

| Level | ∆ | Level | ∆ | Level | ∆ | Level | ∆ | ||

| ‒1.6089 | ‒14.354 *** | ‒1.577 | ‒15.081*** | ‒0.949 | ‒18.791 *** | ‒0.971 | ‒19.023 *** | ||

| ‒2.4365 | ‒14.354 *** | ‒2.253 | ‒11.694 *** | ‒2.436 | ‒14.354 *** | ‒2.253 | ‒11.694 *** | ||

| ‒1.2050 | ‒5.360*** | ‒0.449 | ‒10.107 *** | ‒0.087 | ‒5.798 *** | ‒0.469 | ‒10.043 *** | ||

| ‒7.1600 *** | ‒27.176 *** | ‒9.276 *** | ‒38.957 *** | ‒6.869 *** | ‒27.172 *** | ‒9.003 *** | ‒29.867 *** | ||

All variables, except for the shipment gap, become stationary after first differencing, suggesting they are integrated of order one, I(1). Consequently, we need to test for cointegration among these variables, excluding the shipment gap, using Eq. 2. It would demonstrate whether, in the long run, producer prices of paper and paper products are influenced by exchange rates and foreign prices.

Table 4 presents the results of the Johansen cointegration test, using both the trace and maximum eigenvalue methods. According to the results of trace and maximum eigenvalue statistics, we reject the null hypothesis of no-cointegration among the variables (R = 0) at the 5% significance level in most cases. However, for paper products, the null hypothesis is rejected at the 10% significance level based on the maximum eigenvalue method. Therefore, we consider that there is at least one cointegration relationship in the system for the industries of paper and paper products.

Table 4.

Cointegration test result

| Hypothesized No. of Cointegration | Papers | Paper products | |||

| Trace | Maximum Eigenvalue | Trace | Maximum Eigenvalue | ||

| R = 0 | 48.444 ** | 30.305 ** | 45.183 ** | 25.224 * | |

| R ≥ 1 | 18.139 | 12.684 | 19.959 | 11.756 | |

| R ≥ 2 | 5.455 | 5.455 | 8.203 | 8.203 | |

Table 5.

Estimation result of the long-run relationship

| Variable | Paper (=1) | Paper products (=2) | |||

| Coefficient | Std. Error | Coefficient | Std. Error | ||

| 0.5385 *** | 0.0244 | 0.3887 *** | 0.0188 | ||

| 0.4526 *** | 0.0535 | 0.3974 *** | 0.0635 | ||

| 0.0008 *** | 0.0001 | 0.0020 *** | 0.0001 | ||

| Constant | ‒1.8638 *** | 0.3325 | ‒0.8677 ** | 0.3537 | |

Once cointegration is confirmed, we can analyze the long-run relationship between the variables using Eq. 2. Table 5 shows the results of the estimation model of Eq. 2, presenting the long-run relationship. The signs of the three estimated coefficients for the long-run relationship equation are all positive for both goods. The coefficients of the exchange rate indicating the size of exchange rate pass-through are 0.539 for paper and 0.389 for paper products, while the coefficients for foreign prices are 0.453 for paper and 0.397 for paper products. Thus, in the long run, a 1% increase in the exchange rate results in a 0.539% increase in the producer price of paper and a 0.389% increase in the producer price of paper products in Korea. Thus, in the long run, fluctuations in the exchange rate are partially reflected in domestic producer prices of the paper industry. The time trend variable indicates a slight upward trend in prices over time.

To analyze the short-run relationship along with the adjustment process, we estimate the error correction model of Eq. 3. Table 6 presents the estimation results of the error correction model for paper and paper products. The error correction terms have negative signs and are statistically significant. This indicates that the producer prices of paper and paper products tend to revert to the long-run equilibrium.

It was also found that exchange rates, foreign prices, and the shipment gap have significant impacts on the producer prices of paper and paper products in the short run. The values of short-run exchange rate pass-through to the producer prices of paper and paper products are 0.161 and 0.273, respectively. These values are lower than the values of long-run exchange rate pass-through. The lower values of the short-run exchange rate pass-through are typical in the literature, which indicates the need for further price adjustment by the suppliers of the goods in the market.8,9) For the case of the pulp industry, both the long-run and short-run values of exchange rate pass-through were close to 1.12) The high exchange rate pass-through for pulp could be attributed to its homogeneous nature and the relatively inelastic demand for pulp regarding with respect to price. Moreover, since paper and paper products have more product differentiation than pulp, there might be less competition and greater price control by the suppliers.

The exchange rate pass-through can vary depending on whether the domestic currency is depreciating or appreciating. Eq. 4 was estimated by separating the changes in the exchange rate into depreciation and appreciation periods. According to the estimation results in Table 7, exchange rate pass-through is statistically significant during the depreciation period, while it is insignificant during the appreciation period. For the case of exchange rate depreciation, a 1% increase (depreciation) in the exchange rate led to a 0.231% increase in producer prices for paper and a 0.419% increase for paper products. The values of exchange rate pass-through during the depreciation period in Table 7 are greater than those for the whole period in Table 6. However, the changes in exchange rate during the appreciation period have no significant impact on the prices of paper and paper products. The insignificant exchange rate pass-through during periods of currency appreciation may result from companies being less willing to lower prices when companies anticipate monetary tightening and a contraction in future demand, which might be followed by further currency appreciation.14)

Table 6.

Estimation result of the error correction model

| Variable | Paper (=1) | Paper products (=2) | |||

| Coefficient | Std. Error | Coefficient | Std. Error | ||

| ‒0.0190 ** | 0.0081 | ‒0.0477 *** | 0.0159 | ||

| 0.1612 *** | 0.0192 | 0.2730 *** | 0.0290 | ||

| 0.2355 *** | 0.0551 | 0.3702 ** | 0.1546 | ||

| 0.0742 *** | 0.0135 | 0.0436 ** | 0.0213 | ||

| Constant | ‒0.0727 *** | 0.0135 | ‒0.0416 * | 0.0212 | |

The coefficients of other variables in Table 7 are similar to those in Table 6, which were estimated without separating depreciation and appreciation periods. The coefficients of the error correction terms were negative and statistically significant at the 10% level. As for the foreign price variables, a 1% increase in the foreign prices of paper and paper products results in 0.236% and 0.301% increase in the producer prices of paper and paper products, respectively. Regarding the impact of the shipment gap, a 1% increase results in increases of 0.066% and 0.053% in the producer prices of paper and paper products, respectively.

Table 7.

Estimation result of the error correction model for exchange rate depreciation and appreciation periods

| Variable | Paper (=1) | Paper products (=2) | |||

| Coefficient | Std. Error | Coefficient | Std. Error | ||

| ‒0.0154 * | 0.0078 | ‒0.0293 ** | 0.0149 | ||

| 0.2308 *** | 0.0223 | 0.4191 *** | 0.0325 | ||

| 0.0082 | 0.0333 | ‒0.0437 | 0.0476 | ||

| 0.2357 *** | 0.0532 | 0.3006 ** | 0.1438 | ||

| 0.0656 *** | 0.0131 | 0.0531 *** | 0.1438 | ||

| Constant | ‒0.0646 *** | 0.0131 | ‒0.0520 *** | 0.0198 | |

4. Conclusions

This study uses an error correction model with a cointegrated relationship to estimate the effects of exchange rates, foreign prices, and shipment gaps on the domestic producer prices of paper and paper products. Given the limited research on the pricing structure of the industries of paper and paper products, this analysis aims to provide valuable insights into how exchange rates and foreign prices influence domestic producer prices, thereby enhancing our understanding of the pricing mechanism in this sector.

The empirical analysis indicates that exchange rates, foreign prices, and the shipment gap significantly affect domestic producer prices of paper and paper products. The estimates from the cointegrated equation indicate that the long-run exchange rate pass-through is 0.539% for paper and 0.389% for paper products. Meanwhile, the estimates from the error correction model reveal that the short-run exchange rate pass-through is 0.161 for paper and 0.273 for paper products. Therefore, we found an incomplete exchange rate pass-through and a greater pass-through in the long run, which aligns with previous literature on other industries. The smaller short-run exchange rate pass-through for paper compared to paper products can be attributed to the higher price elasticity of the demand for paper. However, the long-run exchange rate pass-through for paper products is smaller than for paper, possibly due to greater adjustments in managing production costs beyond the exchange rate factor.

When the change of exchange rate was divided into periods of depreciation and appreciation of the Korean currency, the exchange rate pass-through was significant during depreciation but insignificant during appreciation. The pass-through during the depreciation period was 0.231 for paper and 0.419 for paper products. The significant response of producer prices to exchange rate changes suggests that the companies are more proactive in adjusting prices during periods of rising costs than periods of cost reduction caused by exchange rate fluctuations.

Our empirical results indicate that the influence of exchange rates on producer prices tends to increase in the long run compared to the short run, with a more pronounced effect during periods of exchange rate depreciation in the short run. These findings highlight that the impact of exchange rates on producer prices intensifies over time and is particularly significant during depreciation periods. The significant impact of exchange rate fluctuations on domestic producer prices underscores the need for companies in the paper and paper product industries to manage exchange rate risks effectively, in order to mitigate cost increases and maintain price stability.